AccessBlaster

Registered User.

- Local time

- Today, 04:29

- Joined

- May 22, 2010

- Messages

- 7,682

Good luck with that

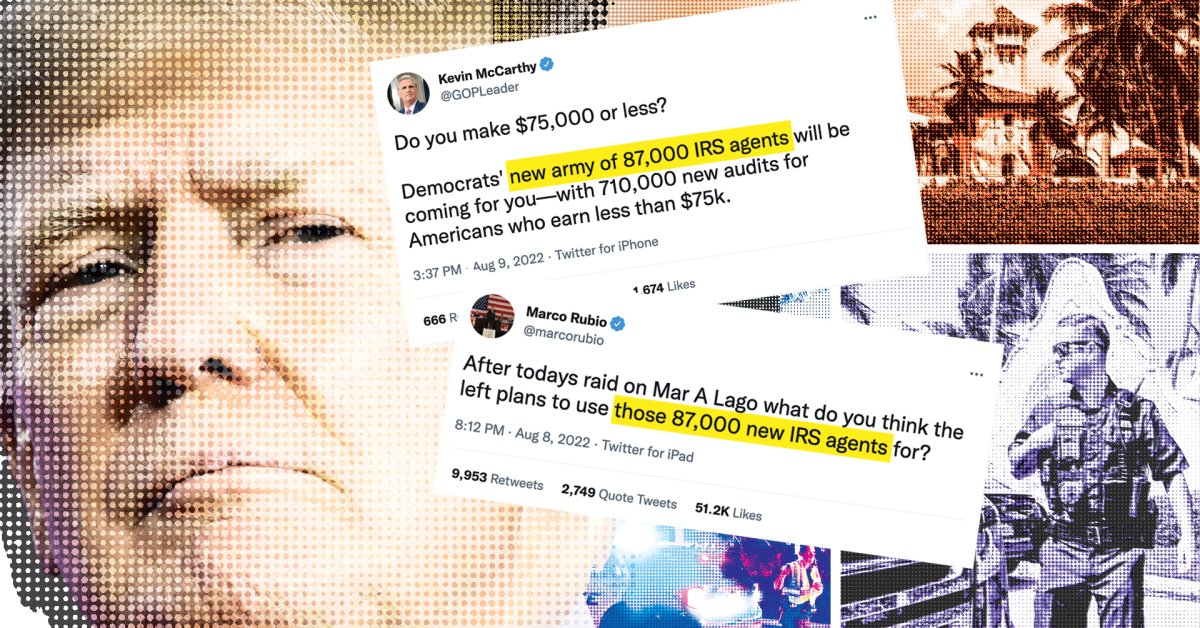

Think you should read the actual legislation. It's nothing like you calim.I guess the idiots who voted for this think that the Dems will ALWAYS be in power or that there really are rich people out there who cheat on their taxes. The IRS audits President Trump and his businesses EVERY SINGLE YEAR. Is that persecution? Do they really expect to find something or are they doing it just because they can and by doing so, they can make him spend hundreds of thousands of dollars every year on accountants that he would not otherwise have to spend.

Anyway, anyone who thinks that Companies and the rich don't pay their fair share of taxes should ask Congress why they keep adding loopholes to the tax code that only favored companies and wealthy individuals can take advantage of. Adding 87,000 new IRS agents isn't going to change this because the tax code isn't changing. Trump did his best to remove loopholes but he was fought tooth and nail by the swamp. I think he got rid of the SALT (which affected me since I live in a high tax state) but since I think the deduction is wrong I was OK loosing it.

So, what I want the actual Democrats to think about is - do you really think these new agents won't ever be sic'd on you? OK, so the Democrats on Congress will sic them on Republicans first, especially known Trump supporters. But eventually, they'll get to you. If the Dems are not in control long enough to get to you, what do you think will happen if the Republicans take the Senate and House this year? Oversight will force them to stop targeting Republicans and that will leave them no one to target except you and the Republicans are not going to stop them from targeting you. And what if God forbid, a Republican is elected President in 2024? He is going to have 87,000 IRS agents with which to target Democrats. You should also ask yourself, would you be happy to vote for hiring 87,000 new IRS agent if Trump had asked for them? Why not

My husband and I had pretty complex tax returns both for us and the business. Our agreement was, if the IRS after reviewing our return asked for less than $1000, we would just pay it because it was cheaper than digging everything out again and paying the accountant to figure out the problem.

Please explain what the legislation says so that we can have an understanding.Think you should read the actual legislation. It's nothing like you calim.

The why is actually because they often claim the EITC and they receive a letter asking for more proof or denial of eligibility. Not exactly gun toting IRS agents busting down the doors.Out of ~700k audits less than .5% are for the very rich. 60% of those currently audited declare < $25,000 of income. WHY, because, that's where the cheating happens. THOSE are the people who don't declare income and that is why the IRS targets them.

Most audits are cordial. It was pretty surprising to see the job ad for agents mentioning that they would be armed. It was posted here last year if someone remembers where, maybe they can post a link.

How do you audit guns?You need to understand just who the new 87,000 agents armed with guns would be auditing. Yes - GUNS.

I love that article, I noticed it a few weeks ago and it literally says that they're not hiring them while also admitting that they are

No, Biden is Not Hiring 87,000 New IRS Agents

It's a false claim being spread by prominent Republicans after the FBI searched Trump's home.time.com