Rich:

I don't vote for them therefore I have a more refined diet............

Your input might be improved but the output is about the same.

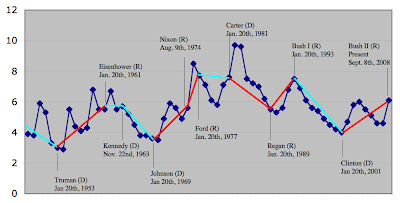

You disprove the graph by facts and not Republican rhetoric

No. You made the assertion, you must provide the authentication. When that data source was analyzed, it appeared that it followed NO rules of statistics, employed no economic models, and didn't even try to allow for lag-time in visibility of effects. Facts? I don't need no steenkin' facts to refute a graph that is void of valid theoretical treatments.

You want to know what boosts employment? Credit. You want to know what kills employment? Lack of credit.

Small businesses in the USA operate using short-term loans to balance irregular cash flow. They use longer-term loans for new projects. When they cannot get a loan because of tightening credit, they can't afford to employ as many people. The Feds have almost nothing to do with credit. They control the lending rate (the prime rate) for federal bank loans. Right now very low. (Did I see 1.5% after yesterday?)

Look to history. Japan used a similar system until they hit the impossible situation of a 0% government loan not being enough to boost the economy. That is when the Japanese economic roller-coaster took the big dive.

Look to history. The USA's crash of 1929 was basically a failure of the banks to have enough cash to make loans. So folks made runs on their local banks and as a result, no businesses could get loans.

Our economic models base their "available" money models on several issues including dollars in circulation, dollars committed via loans, dollars issued as credit in a credit card (at least a few models do this), money on reserve in various places... but when the total money supply is not enough to meet demand, you run into these credit slowdowns that get you into downward spirals.

So how do you increase money? Well, that's tougher. If the government just "issues" it then they dilute the value of the dollars already in circulation. Ditto expanding credit lines! If the amount of money grows but isn't backed by something, you have

inflation and what it means is that it costs more of those devalued dollars to do the same thing. And THAT is because the REAL source of backing isn't something physical. Look up Gross Domestic Product. LABOR should back your dollars.

When considered the foreign exchange rates, they represent "spot" adjustments to the value of dollars, euros, yen, pesos, francs, deutch-marks, lira, dinars, etc. Because if it weren't for the foreign exchange system, EVERY ONE OF THOSE would be worthless outside of the country where they were issued. That occurs because money is just an artificial symbol representing the value of something. We use it so that we can compare disparate prices in common units. Otherwise, we'd be bartering instead of buying.

The real value of a country is the value of its labor. In a global economy, some of the turmoil we see is because we now have cheaper access to foreign cheap labor. BUT the turmoil gets crazier because oil prices make that access more expensive again.

You want to track unemployment? Track credit, GDP, and basic commodity prices, then allow 3-9 months lag time.