I don't have to guess, wealthier organizations can spend money on accounting and legal teams because the scale of their savings is greater than the cost of those efforts.They intentionally make it over complicated for a reason, can you guess the reason?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Should taxes be raised on the wealthiest people?

- Thread starter Thales750

- Start date

I will answer these as I read them.The reason that long term gains are usually taxed at a more favorable rate than ordinary income is because someone was smart enough to realize that capital gains include inflation (which is government caused for the most part) so the longer you've held something the more its selling price has been impacted by inflation rather than true appreciation.

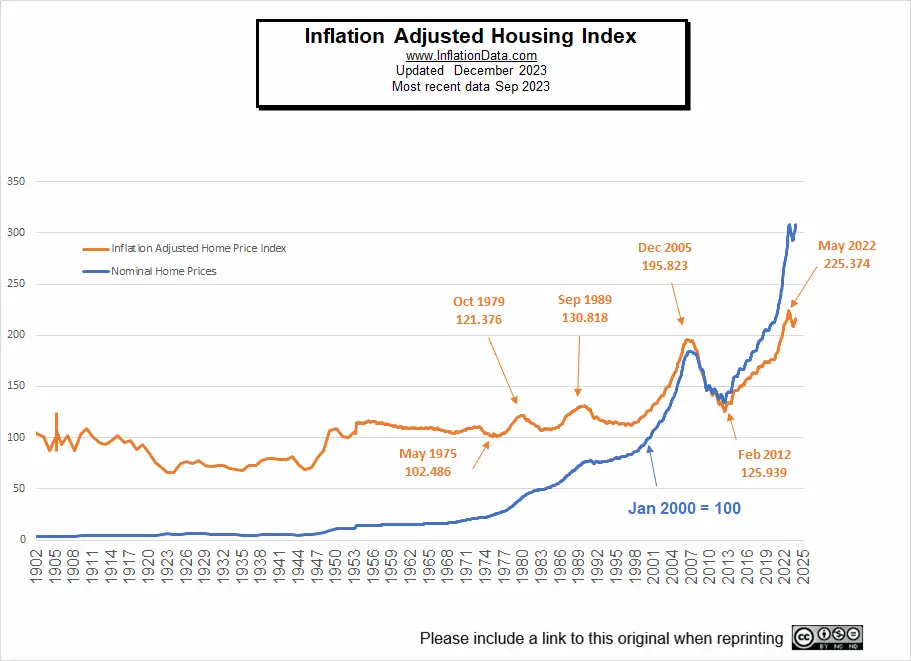

1. You are partially correct, Inflation does effect return on investment. Although, you can look at this chart and be able to tell that for the last 40 years inflation has not been a major factor.

Historical Inflation Rates: 1914-2025

The table displays historical inflation rates with annual figures from 1914 to the present. These inflation rates are calculated using the Consumer Price Index, which is published monthly by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor. The latest BLS data, covering up to...

In that time period, Increases in Real estate have been considerably greater than the inflation rate, negating your position on lowered capital gains taxes.

side bar: We already have a virtual lifetime deferment on our homestead capital gains so you probably don't need to add that point to your arsenal.

Adjusted for inflation to keep you from having to do the math

Inflation Adjusted Housing Prices

Inflation-Adjusted Housing Prices show that housing prices don't "always go up" giving an unbiased look w/o inflation clouding the picture.

So these two chart pretty much much show your statement to be mostly inaccurate.

As far as government creating inflation, I would like to hear your take on that.

Last edited:

This is good.The flat tax sounds good on paper but it will never, ever happen. Why? There are too many businesses and therefore people who earn their living off the stupidity of our tax code - not even including the IRS itself. If you have a tax question and call the IRS for an answer, they will tell you that you may not be able to rely on their answer. So, if the employees of the IRS cannot understand the tax code well enough to explain it to you, there is something wrong with this picture. The best we can hope for is a better proportional scaling of the rates. Having 5 rates (or whatever we have today) is very bad for the low end earners. It would be far better to have 100 smaller steps. It's like a database, a table with a million rows is no more complex than a table with 10 rows. It is all those deductions that make the tax code more complex. Having 100 steps, allows the very poor to pay a very small amount of tax every year. The point being to make sure they understand that government money comes from THEM. It is not simply "free" money. The wealthy already pay a disproportionate percentage of the tax burden despite all their deductions. They could pay more and some effort should be made to simplify the tax code by reducing deductions, especially deductions that are only available to a certain class of people.

I agree not political, thank you.But, as the others have already mentioned, the real problem is that government has no incentive to live within their means. Not to disparage Navy men whom I dearly love (in my formative years I dated my share of submariners), but the government spends like a drunken sailor. And they do it because they don't see the expenditures as their money but instead as other people's money. When you throw around million and billion and even trillion, you can't actually envision what that means.

The members of Congress constantly lie to the public regarding spending bills. They want to raise spending by 20% next year but the one group talks the other group down to 10% and both sides report that they reduced spending which is an outright lie but the gullible people watching CNN and the nightly news believe the gaslighting. This is a bipartisan lie.

If you've ever run a business or worked for one in a management position, you understand zero-based budgeting. EVERY expense you have starts from 0. You don't start from last year's numbers and add 3% for inflation. You even have to justify spending as much as you did last year. Granted, this is more done in the ideal than in practice but if your rent is too high, you figure out how much it would cost to move and how much time it would take to recoup the moving expense. If your heating bill is too high, you figure out if you can solve the problem with capital upgrades to windows and insulation for example.

So far I have not said anything that should be construed as even the slightest bit political. That comes if the conversation turns to WHAT the government decides to spend my money on.

Government overspending is, at least, a double edged sword. Obviously ideology really is not as big of a factor here, they all use spending as a way to gain influence, that is our system. But it is more than that.

Last edited:

Steve R.

Retired

- Local time

- Today, 11:04

- Joined

- Jul 5, 2006

- Messages

- 5,599

How does society benefit from a flat tax?

Your response discloses that your original proposition was a loaded statement: "Should taxes be raised on the wealthiest people?"So how would that work, with the entirety of the wealth of the world in the hands of a few people?

How would the People benefit?

Based on your response you seem to believe that the poor are entitled to "steal" from the rich through taxation.

The purpose of taxation, which you seem to dismiss, is to pay for governmental services such as sewer, water, trash, military, police, environmental protection, etc. Society benefits, from taxes that are used to pay for these services.

Your proposition is also flawed from the context that there will always be endless incessant demands that the rich pay more and more and more and more. When will it end?

PS: It will never end. Witness the example of the minimum wage. No matter how much it is increased, it is never enough.

In the early 60s the highest tax rate was 92%. Lowering the upper tax bracket is the single largest contributer to our people's financial problems.Your response discloses that your original proposition was a loaded statement: "Should taxes be raised on the wealthiest people?"

Based on your response you seem to believe that the poor are entitled to "steal" from the rich through taxation.

The purpose of taxation, which you seem to dismiss, is to pay for governmental services such as sewer, water, trash, military, police, environmental protection, etc. Society benefits, from taxes that are used to pay for these services.

Your proposition is also flawed from the context that there will always be endless incessant demands that the rich pay more and more and more and more. When will it end?

PS: It will never end. Witness the example of the minimum wage. No matter how much it is increased, it is never enough.

One of our fundimental freedoms is to select our leaders, how is it that you believe the most successful investors should rule the world?

I've never agreed with the increase in minimum wage. That is a complicated side bar. It deserves its own thread.

Lightwave

Ad astra

- Local time

- Today, 16:04

- Joined

- Sep 27, 2004

- Messages

- 1,537

I know they aren't flavour of the month at the moment but Russia implemented flat rate taxation in 2001How does society benefit from a flat tax?

Here's a link...

The following year real revenue from tax collection increased by about 26 percent. I actually attended a lecture at Edinburgh University by Alexei Kudrin who was the finance minister at that time.. Flat rate was set to 13 percent dramatically reducing its higher rates.

The benefits of having an autocratic system

In January 2025 they will move to a progressive tax system to help pay for their war.

As soon as Russia can stop their militirasation they might get somewhere.

arnelgp

..forever waiting... waiting for jellybean!

- Local time

- Today, 23:04

- Joined

- May 7, 2009

- Messages

- 20,186

i love your fingerstyleIt's like asking "Should a guitar player turn the bias level on their tube amp well beyond a safe level to get a really killer sound? If you don't mind destroying the tube amp every performance, then go right ahead. The guitar amp doesn't care if your wealthy or not, it will still have a very short lived existance if is pushed beyond its limits.

Steve R.

Retired

- Local time

- Today, 11:04

- Joined

- Jul 5, 2006

- Messages

- 5,599

You must be kidding! Based on your ridiculous premise, the tax rate on the rich should be increased. The financial problems are the result of excessive government deficit spending.Lowering the upper tax bracket is the single largest contributer to our people's financial problems.

Mike Krailo

Well-known member

- Local time

- Today, 11:04

- Joined

- Mar 28, 2020

- Messages

- 1,681

And because government is way bigger than it was originally intended.You must be kidding! Based on your ridiculous premise, the tax rate on the rich should be increased. The financial problems are the result of excessive government deficit spending.

JonXL

Active member

- Local time

- Today, 10:04

- Joined

- Jul 9, 2021

- Messages

- 159

Ten per cent to a person making $250/week is not the same pain as 10% is to Elon Musk.Sure. All people should pay the same percentage in my opinion. I've seen it work perfectly fine for a church tithe. 10% is the same pain to a poor person as 10% is to a wealthy person, hence the percent. No, taxes should not be raised on the wealthiest people - they already are.

For one, it very well could mean going without food for several nights or more that week. For the other it's a rough stock market day followed by a Marijuana-fueled tweet storm.

I'll leave it to you to figure out which is which.

JonXL

Active member

- Local time

- Today, 10:04

- Joined

- Jul 9, 2021

- Messages

- 159

You're confounding simplified tax and flat tax. They aren't the same.It simplifies the process obviously, it eliminates thousands of pages of gobbledygook in the current tax code. Second, if I know I owe 10% to the government it's easy math no third party is needed.

Side note: I'm middle class and my taxes are absurdly easy - even when I do them myself.

AngelSpeaks

Well-known member

- Local time

- Today, 10:04

- Joined

- Oct 21, 2021

- Messages

- 686

Taxes should be fair and not discriminate. Taxes are used to pay for services all people have access to (and of course to line the pockets of greedy and thieving politicians).

Taxes are levied on everything. Sales tax, gasoline tax, property tax, income tax, utilities tax, inheritance tax, etc.

Whereas some wealthy can find legal ways to reduce their income tax, property taxes and inheritance taxes can get them. The Wrigley family had to sell Wrigley Field and the Chicago Cubs to pay for the inheritance tax because the father and mother's deaths were so close together, their heir couldn't afford the tax.

Taxes are levied on everything. Sales tax, gasoline tax, property tax, income tax, utilities tax, inheritance tax, etc.

Whereas some wealthy can find legal ways to reduce their income tax, property taxes and inheritance taxes can get them. The Wrigley family had to sell Wrigley Field and the Chicago Cubs to pay for the inheritance tax because the father and mother's deaths were so close together, their heir couldn't afford the tax.

You mean like historical data?You must be kidding! Based on your ridiculous premise, the tax rate on the rich should be increased. The financial problems are the result of excessive government deficit spending.

Is there a problem with that?The Wrigley family had to sell Wrigley Field and the Chicago Cubs to pay for the inheritance tax because the father and mother's deaths were so close together, their heir couldn't afford the tax.

AngelSpeaks

Well-known member

- Local time

- Today, 10:04

- Joined

- Oct 21, 2021

- Messages

- 686

What kind of dumb ass question is that? Taxes so high that a family that for decades owned something has to give it up to pay a tax because someone died?Is there a problem with that?

It's a good question, sorry you can't understand it?What kind of dumb ass question is that? Taxes so high that a family that for decades owned something has to give it up to pay a tax because someone died?

All those great grand kids got paid for the property. They probably had options that you aren't aware of, and took the road they traveled so they could buy a Condo in Costa Rica.

I design houses for those kinds of folks, I know what goes on behind the scenes, as usual, people that get emotional about these things are almost always the most brainwashed.

Last edited:

Steve R.

Retired

- Local time

- Today, 11:04

- Joined

- Jul 5, 2006

- Messages

- 5,599

An empty unsupported statement.You mean like historical data?

Lightwave

Ad astra

- Local time

- Today, 16:04

- Joined

- Sep 27, 2004

- Messages

- 1,537

Tax collection is independent of what tax is used for..

If someone's else's wealth is not at the expense of your wealth you should always encourage wealth creation.

I've demonstrated that there are examples of tax being lowered at the higher rate and this increasing the total public purse. I linked to an IMF research study on the subject. So this proposal that higher tax will definitely result in a greater tax intake isn't categorically true.

The objective of tax should not be to simply persecute those that have more... It should be to adeqately cover services that are better funded by a national body... In the UK we also have personal allowances that exempts your initial income up to a level from any and all taxation. I myself would not get rid of personal allowances but would suggest that once tax kicks in then it should be flat. I expect all taxation systems have a personal allowance system.

We are trying to get to a positive sum game... Any taxation system with a combination of factors that is zero sum or negative sum should be ditched.

For me re-distribution of wealth should not be the objective - the objective should be to maximise total wealth.

If someone's else's wealth is not at the expense of your wealth you should always encourage wealth creation.

I've demonstrated that there are examples of tax being lowered at the higher rate and this increasing the total public purse. I linked to an IMF research study on the subject. So this proposal that higher tax will definitely result in a greater tax intake isn't categorically true.

The objective of tax should not be to simply persecute those that have more... It should be to adeqately cover services that are better funded by a national body... In the UK we also have personal allowances that exempts your initial income up to a level from any and all taxation. I myself would not get rid of personal allowances but would suggest that once tax kicks in then it should be flat. I expect all taxation systems have a personal allowance system.

We are trying to get to a positive sum game... Any taxation system with a combination of factors that is zero sum or negative sum should be ditched.

For me re-distribution of wealth should not be the objective - the objective should be to maximise total wealth.

AccessBlaster

Registered User.

- Local time

- Today, 08:04

- Joined

- May 22, 2010

- Messages

- 7,439

If you cared about the poor you would stop printing money immediately, inflation is the cruelest form of taxation.

Similar threads

- Replies

- 43

- Views

- 1,649

- Replies

- 28

- Views

- 1,175

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)